Policy shakeup, tariffs, and rate cut hopes drive market sentiment

Markets enter the new week with a complex mix of political interference in key institutions, growing expectations for US interest rate cuts, and global equity volatility triggered by tariffs and trade uncertainty. Investors are closely monitoring developments from Washington, the Fed, and global trade talks, as these forces combine to shape short-term market positioning and long-term macro risk.

Trump to Appoint New Fed Governor and Jobs Chief

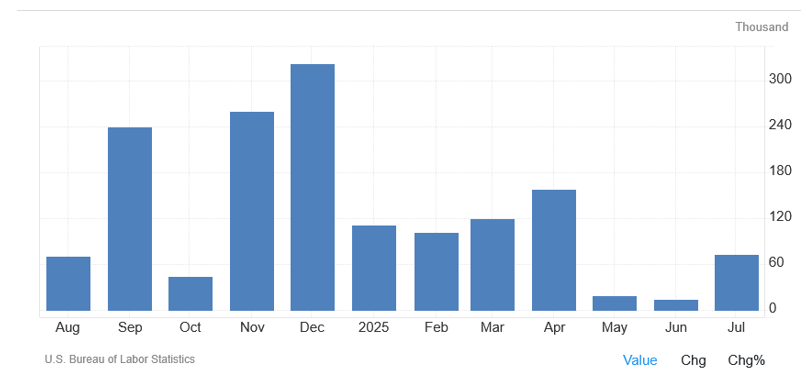

President Trump announced plans to appoint a new Federal Reserve governor and a new head of the Bureau of Labor Statistics (BLS) in the coming days. The announcement comes after Trump fired BLS chief Erika McEntarfer, following a weak jobs report that showed downward revisions to May and June figures. This move has drawn criticism for undermining statistical independence.

The exit of Fed Governor Adriana Kugler also paves the way for Trump to influence monetary policy more directly. Her early departure, months ahead of her term’s scheduled end, presents an opening for Trump to nominate a rate-friendly official. Names floated for consideration include Kevin Warsh, Christopher Waller, Scott Bessent, and Kevin Hassett. Notably, the appointed governor could eventually ascend to the chairmanship when Powell’s term ends in May.

Markets are viewing this institutional shake-up as a sign that Trump aims to press the Fed harder for rate cuts ahead of the 2026 campaign season.

Markets Rebound on Rate Cut Bets

Equity markets recovered some of Friday’s steep losses after soft labor data sparked renewed hopes of a Federal Reserve rate cut in September. S&P 500 futures rose 0.5%, the Stoxx Europe 600 gained 0.1%, and Nasdaq 100 futures advanced 0.5%.

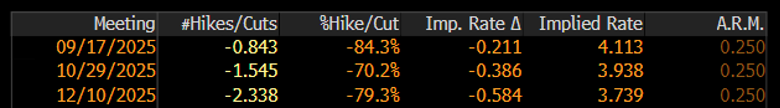

The rebound follows Friday’s sharp declines, when the S&P 500 fell 1.6% and Nasdaq 100 dropped 2% amid weak job creation and higher unemployment. Traders responded by boosting bets on monetary easing. Fed fund futures now imply over an 80% probability of a rate cut in September, with some pricing in a 50 basis point move—double the standard increment.

Yields responded accordingly: the 10-year Treasury yield is up three basis points to 4.25%, after falling 16 bps on Friday. Two-year yields dropped even more last week, signaling aggressive repricing of rate expectations.

Swiss Stocks Hit by Tariff Shock

Swiss equities came under pressure Monday as markets reopened after a holiday, reacting to the announcement of a 39% US export tariff on Swiss goods. The Swiss Market Index dropped 1.4%, nearly wiping out 2025 gains. Major constituents like Roche and Novartis were hit hard, down 2.1% and 1.2%, respectively.

The timing of the tariff announcement—on Swiss National Day—meant local markets had yet to fully digest the impact. Beyond the tariffs, Trump also demanded global drugmakers lower prices for medications sold to Medicaid, sending further shockwaves across the pharma sector.

The Swiss franc fell for a second consecutive day against the euro, sliding 0.3%, following a 0.5% decline on Friday—its largest since May. Despite this, some investors note that the franc’s traditional safe-haven status may cushion equity downside in the medium term.

Currency & Commodities Snapshot

- USD: The Bloomberg Dollar Spot Index is slightly lower, continuing its post-payrolls pullback.

- EUR/USD: Down 0.1% to 1.1570.

- USD/JPY: Up 0.3% to 147.84.

- Offshore Yuan: Rises 0.2% to 7.1784.

- Gold: Little changed amid offsetting rate cut optimism and geopolitical concerns.

- Brent Crude: Steady at $69.79 per barrel, as OPEC+ wraps up a phase of major output hikes.

Corporate Highlights

UBS: Shares fell more than 2% after agreeing to a $300 million US settlement over a mortgage-related case.

BYD: The Chinese EV maker slid in Hong Kong as monthly sales growth faltered.

UK Banks: Lloyds surged 5% and Barclays gained 2% after a favorable legal outcome in a UK car financing case.

Trade Watch: China and Rare Earths

While global focus remains on tariffs, the US Trade Representative reported constructive dialogue with China over rare earth supply flows. Though still early, this has eased some tensions between the world’s largest economies, offering a tentative tailwind to risk sentiment.

With institutional reshuffling at the Fed and BLS, and the political pressure mounting on monetary and labor data institutions, policy independence is in focus. Meanwhile, investors are recalibrating for a potential shift in Fed policy, with September now expected to bring the next major move.

Despite tariff noise and corporate headwinds, the broader market remains supported by growing conviction that rate cuts will soon return to the monetary toolbox. However, volatility is likely to persist as political influence, economic data, and central bank credibility intersect in a high-stakes environment.